As the world of trading continues to evolve, it's essential to stay ahead of the curve to maximize your profits. One often-overlooked aspect of trading is pre-market trading, which can provide a significant edge for investors who know how to navigate it. In this article, we'll delve into the world of pre-market trading, exploring its benefits, risks, and strategies, with a focus on

Benzinga Pro as a valuable tool for traders.

What is Pre-Market Trading?

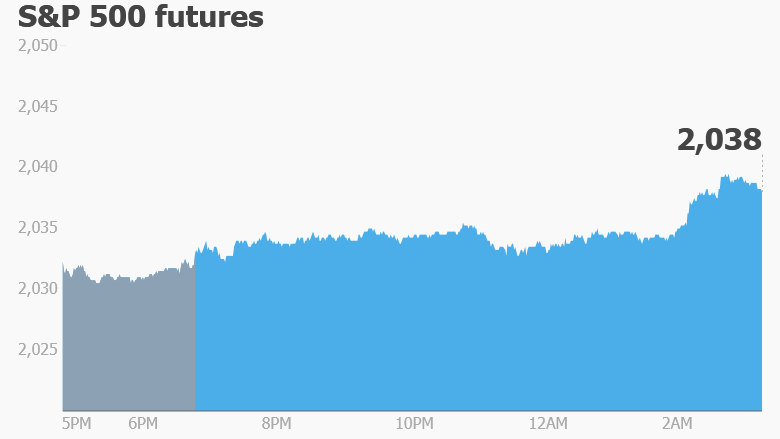

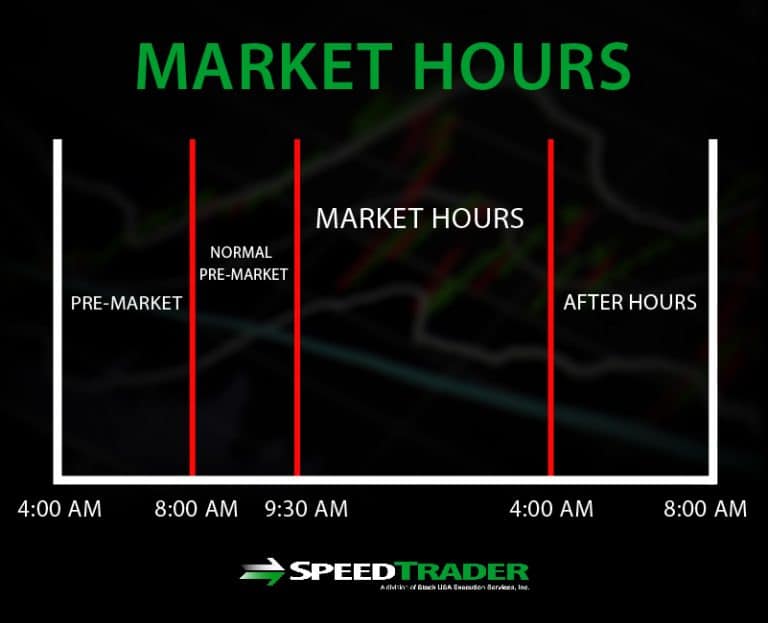

Pre-market trading refers to the buying and selling of securities before the official market opening. This period, typically between 8:00 am and 9:30 am ET, allows traders to react to overnight news and events that may impact the market. Pre-market trading is available for various financial instruments, including stocks, options, and futures.

Benefits of Pre-Market Trading

Pre-market trading offers several advantages, including:

Early access to market-moving news: Traders can react to news and events that occur outside of regular trading hours, potentially gaining an edge over other investors.

Increased liquidity: Pre-market trading provides an opportunity to trade with other investors who are also reacting to overnight news, increasing liquidity and potentially leading to better prices.

Reduced volatility: By trading before the official market opening, investors can avoid the chaos and unpredictability that often accompanies the start of regular trading hours.

Risks of Pre-Market Trading

While pre-market trading offers several benefits, it also comes with unique risks, including:

Limited liquidity: Pre-market trading can be less liquid than regular trading hours, making it more challenging to enter or exit positions.

Wider spreads: The difference between bid and ask prices can be more significant during pre-market trading, increasing trading costs.

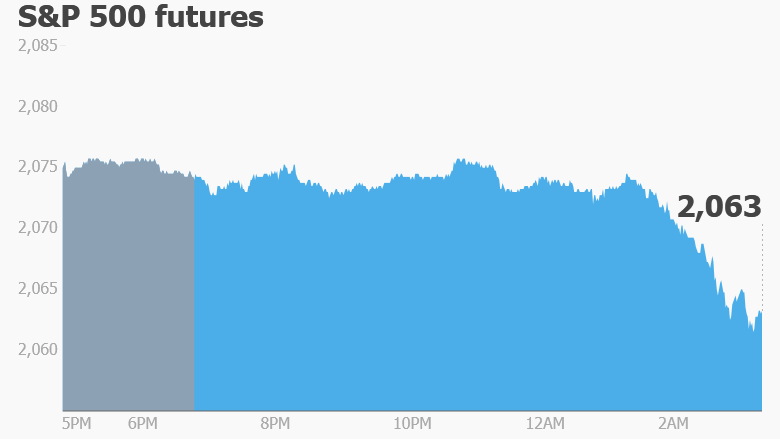

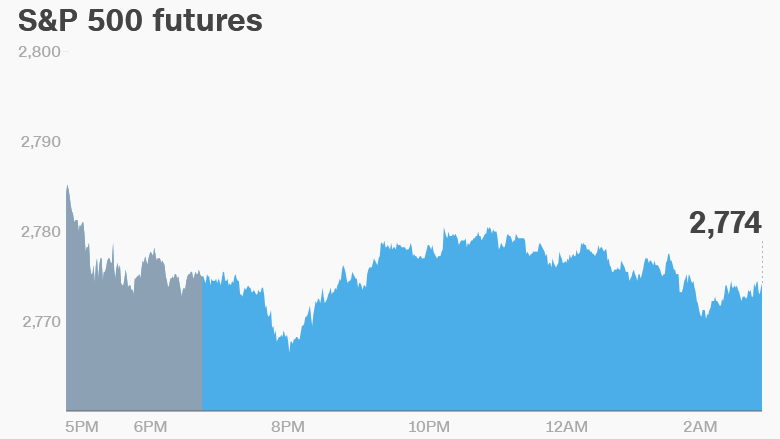

Higher volatility: Pre-market trading can be more volatile than regular trading hours, as news and events can lead to rapid price movements.

Strategies for Pre-Market Trading

To succeed in pre-market trading, it's essential to have a solid strategy in place. Some popular approaches include:

News-based trading: Reacting to overnight news and events that may impact the market.

Technical analysis: Using charts and technical indicators to identify trends and patterns.

Scalping: Taking advantage of small price movements during pre-market trading.

How Benzinga Pro Can Help

Benzinga Pro is a powerful tool for traders, providing real-time news, data, and analysis to help investors make informed decisions. With Benzinga Pro, traders can:

Stay ahead of the curve: Receive real-time news and alerts on market-moving events.

Analyze the market: Use advanced charts and technical indicators to identify trends and patterns.

Make informed decisions: Access expert analysis and insights to help guide trading decisions.

In conclusion, pre-market trading can be a valuable addition to any trading strategy, offering early access to market-moving news, increased liquidity, and reduced volatility. However, it's essential to be aware of the unique risks and challenges associated with pre-market trading. By using a tool like Benzinga Pro and developing a solid strategy, traders can unlock the secrets of pre-market trading and maximize their profits in 2024. Whether you're a seasoned trader or just starting out, pre-market trading is definitely worth exploring. So, take the first step today and discover the potential of pre-market trading with Benzinga Pro.